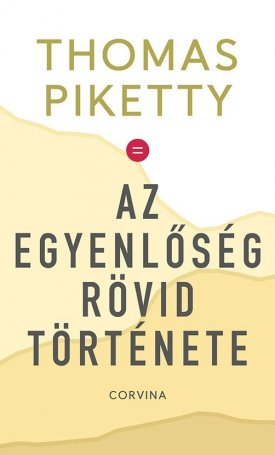

Economics of Inequality, The

-10%

8 710 Ft

7 839 Ft

Előrendelés(Bejelentkezés szükséges)

A kedvezményes árak kizárólag a webshopunkon keresztül leadott megrendelésekre érvényesek!

Economics of Inequality, The

Borító: Kötött

ISBN: 9780674504806

Méret: 142*225

Tömeg: 282 g

Oldalszám: 160

Megjelenés éve: 2015

Piketty begins by explaining how inequality evolves and how economists measure it. In subsequent chapters, he explores variances in income and ownership of capital and the variety of policies used to reduce these gaps. Along the way, with characteristic clarity and precision, he introduces key ideas about the relationship between labor and capital, the effects of different systems of taxation, the distinction between “historical” and “political” time, the impact of education and technological change, the nature of capital markets, the role of unions, and apparent tensions between the pursuit of efficiency and the pursuit of fairness.ISBN: 9780674504806

Méret: 142*225

Tömeg: 282 g

Oldalszám: 160

Megjelenés éve: 2015

Succinct, accessible, and authoritative, this is the ideal place to start for those who want to understand the fundamental issues at the heart of one of the most pressing concerns in contemporary economics and politics.

Thomas Piketty—whose Capital in the Twenty-First Century pushed inequality to the forefront of public debate—wrote The Economics of Inequality as an introduction to the conceptual and factual background necessary for interpreting changes in economic inequality over time. This concise text has established itself as an indispensable guide for students and general readers in France, where it has been regularly updated and revised. Translated by Arthur Goldhammer, The Economics of Inequality now appears in English for the first time.

Table of contents

Note to the Reader

Introduction

1. The Measurement of Inequality and Its Evolution

Different Types of Income

Wage Inequality

International Comparisons

Income Inequality

International Comparisons

Inequalities in Time and Space

The Historical Evolution of Inequality

From Laws of History to Uncertainties

From Wages to Incomes

Inequality with Respect to Employment

2. Capital-Labor Inequality

The Share of Capital in Total Income

The Question of Capital/Labor Substitution

What Capital/Labor Substitution Means

Redistribution: “Fiscal” or “Direct”?

The Elasticity of Substitution between Capital and Labor

The Elasticity of Capital Supply

Are Capitalists and the Price System Necessary?

A Compromise between Short-Term and Long-Term Theories?

From Share of Value-Added to Household Income

What the Constancy of the Profit Share Tells Us

Who Pays Social Charges (Payroll Taxes)?

A Cobb-Douglas Production Function?

Historical Time versus Political Time?

Why Has the Profit Share Not Increased in the United States and United Kingdom?

The Dynamics of the Distribution of Capital

The Theory of Perfect Credit and Convergence

The Question of Convergence between Rich and Poor Countries

The Problem of Capital Market Imperfections

Possible Public Interventions

A Flat Tax on Capital?

3. Inequality of Labor Income

Inequality of Wages and Human Capital

The Explanatory Power of the Theory of Human Capital

Important Historical Inequalities

Supply and Demand

The Rise of Wage Inequality since 1970

Skill-Biased Technological Change?

Wage Inequality and Globalization

How to Redistribute Labor Income

A Major Political Issue

Where Does Human Capital Inequality Come From?

Efficient Inequality?

The Role of the Family and Educational Expenses

The Problem of Inefficient Segregation of Human Capital

Discrimination in the Labor Market

Affirmative Action versus Fiscal Transfers

The Social Determination of Wage Inequality

The Role of Unions in Setting Wages

Unions as Substitutes for Fiscal Redistribution?

Do Unions Contribute to Economic Efficiency?

The Monopsony Power of Employers

When Does a Higher Minimum Wage Increase the Level of Employment?

Efficiency Wages and Fair Wages

National Traditions and Wage Inequality

4. Instruments of Redistribution

Pure Redistribution

Average and Marginal Rates of Redistribution

The Absence of Redistribution between Workers

The U-Shaped Curve of Marginal Rates

Just Fiscal Redistribution

Do High Taxes Diminish Revenue?

The Earned Income Tax Credit in the United States

Fiscal Redistribution to Reduce Unemployment?

Negative Income Tax and Basic Income

Efficient Redistribution

Redistribution and Social Insurance

Efficient Social Insurance

Is Social Insurance an Instrument of Fiscal Redistribution?

Redistribution and Demand

References

Contents in Detail

Index